exchange rate-12/05

2020年12月5日616 world famous ports(With global basic port and route comparison)

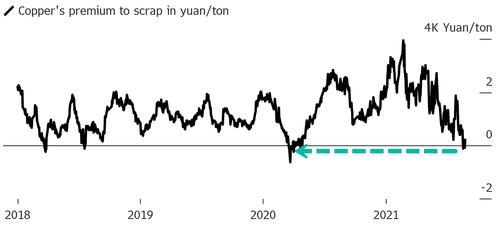

2021年11月5日A rare scenario has emerged: copper prices are lower than scrap prices

Copper and other industrial metals retreated overnight on Thursday (August 26), ending earlier in the week, as the dollar rose ahead of the annual meeting of the Jackson Hole Global Central Bank. However, the re-emergence of a rare phenomenon in commodity futures markets, more than a year later, is sniffing out potential opportunities for some copper bulls, with refined copper prices once again below scrap prices.

Colin Hamilton, managing director of commodities research at Bank of Montreal, said this week that buyers appeared to have re-entered the market after months of correction in copper prices. He pointed out that the spot price of high-grade scrap copper in China was already higher than the price of refined copper over the weekend. This is a strong indication that the supply of copper scrap is rapidly declining.

The last time this happened was in April last year, when central banks and governments around the world pumped trillions of dollars into the economy. LME copper, on the other hand, soared after bottoming out in the first quarter of the year, breaking through the $10,000 mark in May and hitting an all-time high of $10,747.

Hamilton points out that rising scrap prices and insufficient supply have shifted some demand to buy refined copper directly, which could push up the latter prices.

Colin Hamilton said: "This is clearly an unusual move, and while it doesn't make much sense on an economic level, it's a sign that the market sell-off may have gone beyond the fundamentals themselves." We do see some initial signs that Chinese buyers have stopped destocking and are returning to the market. "

Despite the fall in copper prices over the past few months, LME copper prices have risen 126 per cent since last year's lows, and the overall upward trend has not completely shifted.

The last time this happened was in April last year, when central banks and governments around the world pumped trillions of dollars into the economy. LME copper, on the other hand, soared after bottoming out in the first quarter of the year, breaking through the $10,000 mark in May and hitting an all-time high of $10,747.

Hamilton points out that rising scrap prices and insufficient supply have shifted some demand to buy refined copper directly, which could push up the latter prices.

Colin Hamilton said: "This is clearly an unusual move, and while it doesn't make much sense on an economic level, it's a sign that the market sell-off may have gone beyond the fundamentals themselves." We do see some initial signs that Chinese buyers have stopped destocking and are returning to the market. "

Despite the fall in copper prices over the past few months, LME copper prices have risen 126 per cent since last year's lows, and the overall upward trend has not completely shifted.

The market was strong after the copper price.

Copper is used in electricity and construction. Many analysts expect demand for copper to be strong as fossil fuels are replaced by electrification. In fact, in addition to the rare upside-down between the above-mentioned scrap and refined copper prices, there are no shortage of signs of bullish post-market prospects in some other areas.

China's Yangshan copper import premium recently rose above $100 a tonne from $21 in June, suggesting stronger demand for overseas metals in China, traditionally the world's largest buyer of copper in the physical market.

In addition, copper inventories at registered warehouses on the London Metal Exchange have fallen to 178125 tonnes from nearly 240,000 tonnes a week ago. The spread between LME spot copper and three-month contracts has risen to a premium from about $30 in mid-August, indicating tighter supply of metals for quick delivery.

"I don't see the real reason to be bearish ... There is room to break records," Gianclaudio Torlizzi of T-Commodity, a consultancy, said on Wednesday. He also noted that high inflation expectations, falling inventories, rising import premiums in China and positive demand prospects were supporting prices.

On a technical level, Torlizzi expects copper prices to improve as long as they stay above the 200-day moving average of $8,880. LME copper was last trading at $9,297 on Friday.

Goldman Sachs analyst Christian Mueller-Glissmann also recently noted that "copper prices are likely to rise by the end of the year." Our strategists believe that the gap between supply and demand could help copper prices break the bandwaway in the fourth quarter. "

Copper is used in electricity and construction. Many analysts expect demand for copper to be strong as fossil fuels are replaced by electrification. In fact, in addition to the rare upside-down between the above-mentioned scrap and refined copper prices, there are no shortage of signs of bullish post-market prospects in some other areas.

China's Yangshan copper import premium recently rose above $100 a tonne from $21 in June, suggesting stronger demand for overseas metals in China, traditionally the world's largest buyer of copper in the physical market.

In addition, copper inventories at registered warehouses on the London Metal Exchange have fallen to 178125 tonnes from nearly 240,000 tonnes a week ago. The spread between LME spot copper and three-month contracts has risen to a premium from about $30 in mid-August, indicating tighter supply of metals for quick delivery.

"I don't see the real reason to be bearish ... There is room to break records," Gianclaudio Torlizzi of T-Commodity, a consultancy, said on Wednesday. He also noted that high inflation expectations, falling inventories, rising import premiums in China and positive demand prospects were supporting prices.

On a technical level, Torlizzi expects copper prices to improve as long as they stay above the 200-day moving average of $8,880. LME copper was last trading at $9,297 on Friday.

Goldman Sachs analyst Christian Mueller-Glissmann also recently noted that "copper prices are likely to rise by the end of the year." Our strategists believe that the gap between supply and demand could help copper prices break the bandwaway in the fourth quarter. "