The People’s Bank Of China steps in with a 2% increase! Renminbi exchange rate plunges by more than 300 points

2021年12月10日The functional role of filter mesh

2022年3月9日Congestion, epidemic, high demand, air transport, shipping new situation

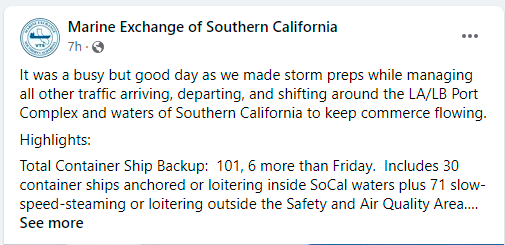

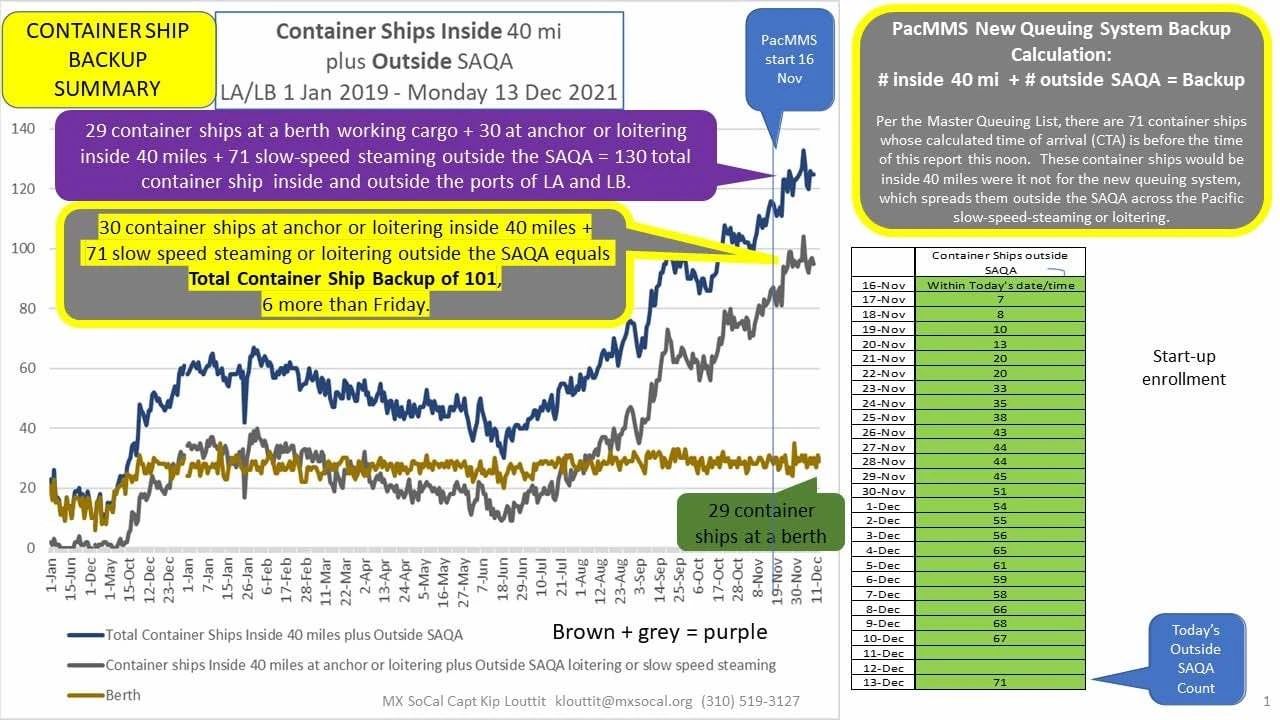

The growing number of container ships waiting to berth at the ports of Los Angeles and Long Beach across the Pacific coastline now numbers more than 100 to 101.

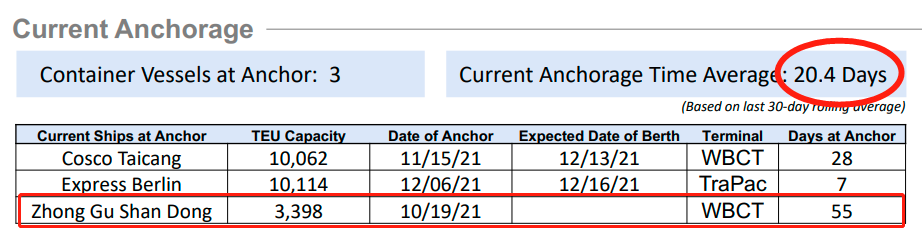

According to the latest data from the Marine Exchange of Southern California, 101 container ships along 1,000 miles of North American coastline are moored or roaming the country's two gateway waterways waiting to berth. Ships that would normally take just two weeks to travel from Asia to North America before the pandemic are now taking up huge capacity due to congestion delays, with some ships berthing for more than 45 days. The Zhonggu Shandong has been waiting for its berth for 55 days.

Although the port of Los Angeles revealed that its waiting list had nearly halved in a week, the congestion had not eased. Last month, U.S. authorities pushed off the California coast anchorage for ships waiting to berth, requiring them to stay 150 miles off the coast. While the vast fleet of containers is out of sight, the number of subsequent jams continues to grow.

Through the Clarksons of Clarksons' data of blocked ports and the data analysis of departing ships of the Port of Los Angeles, port congestion is still not alleviated. The reduction is due to the adjustment of anchorage rules which resulted in some ships not being counted.

On November 15, the Southern California Shipping Exchange changed its anchorage waiting line rules. Under previous rules, ships waiting to enter port could stay within 20 nautical miles of the ports of Los Angeles and Long Beach. Intensified over the past six months port congestion lead to stay parking area are overcrowded, for security and air pollution concerns, the new rules, in addition to the special circumstances, such as mooring ship can only be in the range 150 miles southwest of California and 50 miles from California and Mexico waters waiting, only port within 72 hours notice can entry ships are allowed to slowly close to the port of anchorage near idle. As a result, the gap between cargo vessels has widened and the speed at which goods can enter the port has been lengthened, further exacerbating congestion.

According to the latest data from the Marine Exchange of Southern California, 101 container ships are stranded, with 30 anchored in Southern California waters and 71 drifting slowly or adrift outside designated safety and air quality zones.

"Can you imagine the risk of 101 container ships congregating within 40 miles of Los Angeles during tonight's storm?" Now they're 1,000 miles across, many of them in relatively calm waters south of the Mexican coast." "The exchange said in a Facebook post on Monday.

Through the Clarksons of Clarksons' data of blocked ports and the data analysis of departing ships of the Port of Los Angeles, port congestion is still not alleviated. The reduction is due to the adjustment of anchorage rules which resulted in some ships not being counted.

On November 15, the Southern California Shipping Exchange changed its anchorage waiting line rules. Under previous rules, ships waiting to enter port could stay within 20 nautical miles of the ports of Los Angeles and Long Beach. Intensified over the past six months port congestion lead to stay parking area are overcrowded, for security and air pollution concerns, the new rules, in addition to the special circumstances, such as mooring ship can only be in the range 150 miles southwest of California and 50 miles from California and Mexico waters waiting, only port within 72 hours notice can entry ships are allowed to slowly close to the port of anchorage near idle. As a result, the gap between cargo vessels has widened and the speed at which goods can enter the port has been lengthened, further exacerbating congestion.

According to the latest data from the Marine Exchange of Southern California, 101 container ships are stranded, with 30 anchored in Southern California waters and 71 drifting slowly or adrift outside designated safety and air quality zones.

"Can you imagine the risk of 101 container ships congregating within 40 miles of Los Angeles during tonight's storm?" Now they're 1,000 miles across, many of them in relatively calm waters south of the Mexican coast." "The exchange said in a Facebook post on Monday.

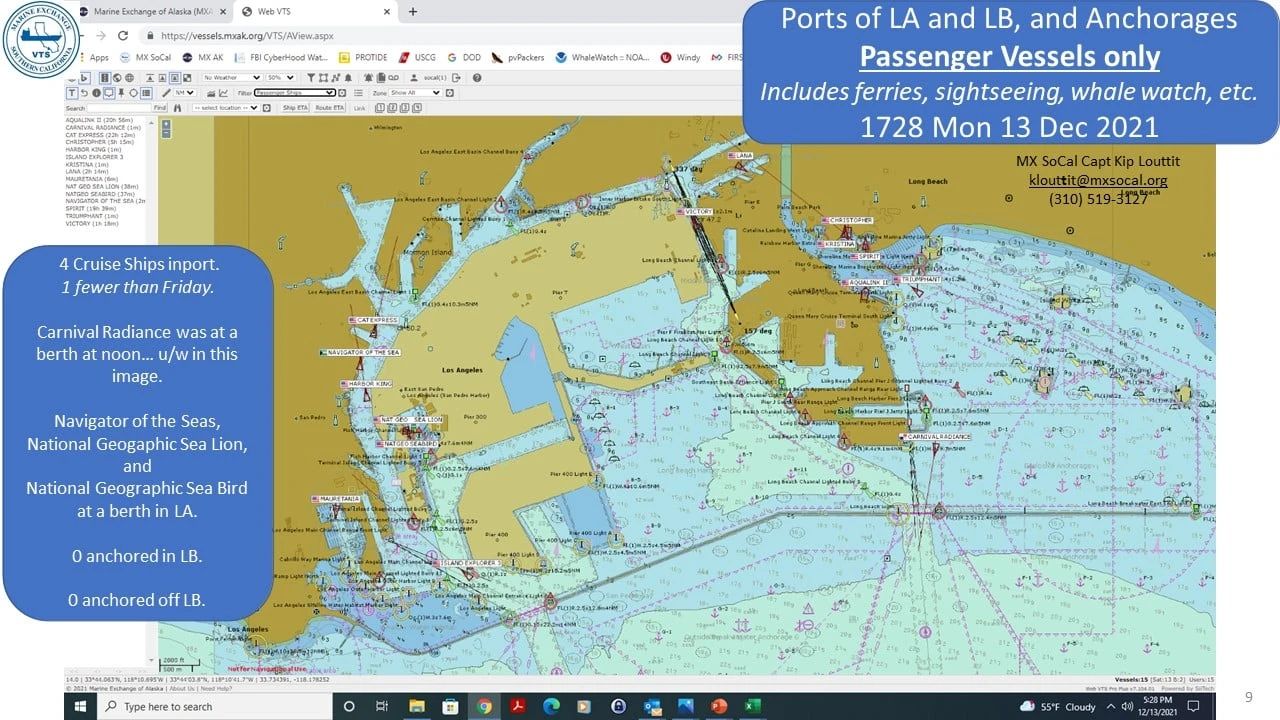

By the night of The 13th, authorities had virtually cleared all boats berthed in Los Angeles and Long Beach in anticipation of the approaching storm.

Sal Mercogliano, an associate professor at Campbell University in North Carolina, points out in the latest video of his popular YouTube series' What's Happening to Shipping 'that the wait times for ships on trans-Pacific trade routes are extremely long. The video points to the Navios Amarillo and Maersk Esmeraldas waiting in the waters off Baja, Mexico, as typical cases.

The 4,250 TEU Navios Amarillo left The South Korean port of Busan on November 17 and is currently in Mexican waters. It is scheduled to dock in Los Angeles on January 2 for 46 days.

Sal Mercogliano, an associate professor at Campbell University in North Carolina, points out in the latest video of his popular YouTube series' What's Happening to Shipping 'that the wait times for ships on trans-Pacific trade routes are extremely long. The video points to the Navios Amarillo and Maersk Esmeraldas waiting in the waters off Baja, Mexico, as typical cases.

The 4,250 TEU Navios Amarillo left The South Korean port of Busan on November 17 and is currently in Mexican waters. It is scheduled to dock in Los Angeles on January 2 for 46 days.

The 13,000-teU Maersk Esmeraldas, which used to dock at Hong Kong, Shenzhen, Yantian and Xiamen ports at the end of November, left Xiamen port two days ago (actually left On December 1) and is still moored off the coast of China. It is scheduled to arrive in Los Angeles on January 11 with a one-month transit time. This shows the scale of congestion on the trans-Pacific route.

The ports of Los Angeles and Long Beach announced on Wednesday that they would postpone for another week the overdue container detention fee they were to collect from shipping companies for the fifth time. The fine was first proposed in October but has yet to be implemented.

With soaring consumer demand being met before Christmas, some importers needed to make sure they could get their goods on shelves in time for the holiday season and had to abandon shipping by air instead.

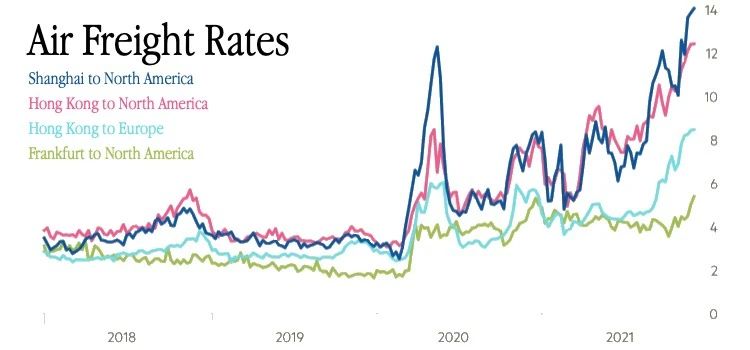

However, air freight to and from major Asian routes has doubled in the past three months, according to statistics. The Financial Times reports that air freight from Shanghai to North America has hit a record high of $14 a kg, up from $8 a kg at the end of August and up from an all-time high of $12 a kg at the beginning of the coronavirus pandemic. But the extra cost of air freight could weigh on consumers through inflation.

With soaring consumer demand being met before Christmas, some importers needed to make sure they could get their goods on shelves in time for the holiday season and had to abandon shipping by air instead.

However, air freight to and from major Asian routes has doubled in the past three months, according to statistics. The Financial Times reports that air freight from Shanghai to North America has hit a record high of $14 a kg, up from $8 a kg at the end of August and up from an all-time high of $12 a kg at the beginning of the coronavirus pandemic. But the extra cost of air freight could weigh on consumers through inflation.

At the same time, air freight prices on similar routes, such as Hong Kong to Europe and the United States, as well as transatlantic routes between Europe and North America, have risen sharply.

"Everyone knows that if you want something to be on the shelves by Christmas, you have to use air freight." Yngve Ruud, global head of air cargo at Kuehne+Nagel, one of the world's largest freight forwarders. "The market expects the peak season and air cargo market demand to continue until March next year," said a freight forwarder.

According to financial Times analysis, there are many reasons for the soaring air freight prices:

•The first is the global shipping jam that has led companies to take to the air to transport products like fashion goods, consumer electronics and components.

• Second, the widespread spread of the omicron strain has created a global demand for COVID-19 testing kits and personal protective equipment.

• Finally, the global supply chain is extremely busy due to holidays such as Black Friday and Christmas in the West.

"Everyone knows that if you want something to be on the shelves by Christmas, you have to use air freight." Yngve Ruud, global head of air cargo at Kuehne+Nagel, one of the world's largest freight forwarders. "The market expects the peak season and air cargo market demand to continue until March next year," said a freight forwarder.

According to financial Times analysis, there are many reasons for the soaring air freight prices:

•The first is the global shipping jam that has led companies to take to the air to transport products like fashion goods, consumer electronics and components.

• Second, the widespread spread of the omicron strain has created a global demand for COVID-19 testing kits and personal protective equipment.

• Finally, the global supply chain is extremely busy due to holidays such as Black Friday and Christmas in the West.

It is understood that some airlines have switched to air freight, while logistics companies such as fedex and DHL are also filling some of the gap to fully cope with the growing demand for this convenient but expensive service.

The airline industry is still running 13 percent below 2019 capacity, while demand is up 6 percent over the same period, creating a gap of nearly 20 percentage points between supply and demand, said Marco Bloemens, head of freight consulting at Accenture's Seabreys. According to the latest statistics and analysis, the current supply chain chaos may not ease until the second half of 2022.

The airline industry is still running 13 percent below 2019 capacity, while demand is up 6 percent over the same period, creating a gap of nearly 20 percentage points between supply and demand, said Marco Bloemens, head of freight consulting at Accenture's Seabreys. According to the latest statistics and analysis, the current supply chain chaos may not ease until the second half of 2022.